- Home

- About Us

- Become Self-Insured

- Alternative Security Program

- Injured Workers

- Knowledge Center

- Newsroom

|

ALTERNATIVE SECURITY PROGRAM (ASP)

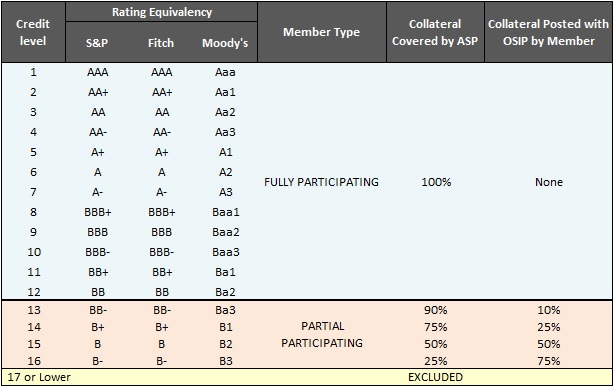

Posting Collateral All employers who self-insure their workers' compensation liabilities are required to post collateral to protect and provide for their injured workers in the event the employer becomes insolvent or is otherwise unable to meet their statutory obligations. How Much Collateral is Required The amount of collateral posted is determined annually by an independent actuary hired by the employer. The actuary evaluates the amount of the employer's total workers' compensation exposure each year and submits their findings to the California Office of Self-Insurance Plans (OSIP). Almost always, the required collateral deposit is an amount equal to the employer's workers' compensation liability as determined by the actuary. In rare instances, the Chief of OSIP may establish a different amount of collateral if there are circumstances that warrant this. How is Collateral Posted Self-insured employers must post collateral in one of two ways. Most self-insured employers meet the credit standards and participate in the Alternative Security Program, which satisfies their collateral posting requirements. Companies that do not meet the credit qualification standards must post their collateral directly with OSIP in one of the four approved financial forms. The OSIP website discusses these forms in greater detail. What is the Alternative Security Program (ASP) The ASP is an innovative first in the nation program operated by the California Self-Insures' Security Fund (the Fund) that provides collateral security for its members that meet the credit qualification guidelines (discussed below). Members are assessed a fee to cover the ASP costs. This assessment fee is similar in cost to the fee a member may pay for a letter of credit or surety bond for their collateral deposit. The assessment fee rate floats in correlation to the member's credit rating. A member's participation in the ASP is mandatory if they meet the credit rating standards. Put another way: ASP members do not tie up their capital in order to post collateral. The ASP not only handles this for participating members, but the ASP collateral does not have any impact on the member employer's balance sheet or impact their borrowing capacity leaving their working capital free and available to operate their business. Credit ratings / Levels The Fund uses a 16-level credit index that corresponds to the rating scales used by credit rating organizations such as Moody's, Standard and Poor's, and Fitch. The Fund assigns each self-insured employer an appropriate credit index level based on the strength and rating of their financial statements. Large publicly traded companies will typically have a formal credit rating with one of these organizations, which will be used by the ASP for assessment purposes. Public companies without a formal credit rating will be assigned an implied rating calculated using Moody's CreditEdge analytics tool. Privately held companies without a formal rating will have an implied rating calculated and assigned to them by the Fund using Moody's RiskCalc™ analytics tool based on the member's audited financial statements. All self-insured employers are assigned a credit level index, based on the index assigned; they will fall into one of three major categories: Fully Participating (Levels 1 – 12) The ASP fully covers the collateral posting.

|